Sales into Mobile Phones More than Double Quarter to Quarter

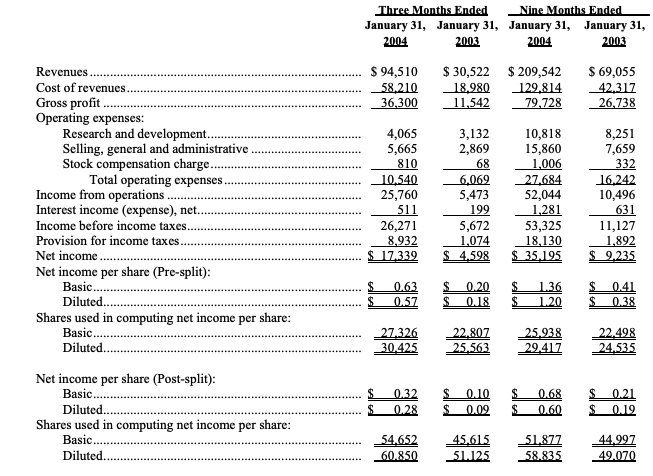

SUNNYVALE, Calif. — February 18, 2004 — OMNIVISION Technologies, Inc. (Nasdaq: OVTI) reported that in the three months ended January 31, 2004, the third quarter of its fiscal year 2004, it earned net income of $17.3 million on revenue of $94.5 million. Earnings per diluted share were $0.28, adjusted for the effect of the two-for-one stock split that occurred on February 17, 2004. Earnings per diluted share, before the effect of the stock split, were equivalent to $0.57. In the comparable period a year ago, the company earned net income of $4.6 million on revenue of $30.5 million, and earnings per diluted share were $0.09, adjusted for the effect of the stock split.

“In the January quarter, sales of CameraChips for mobile phones grew by more than 100% quarter to quarter, and the mobile phone sector emerged as our largest market,” said Shaw Hong, president and chief executive officer. “We believe that the era of the cameraphone is just beginning, and we continue to view this market as a large and exciting opportunity.”

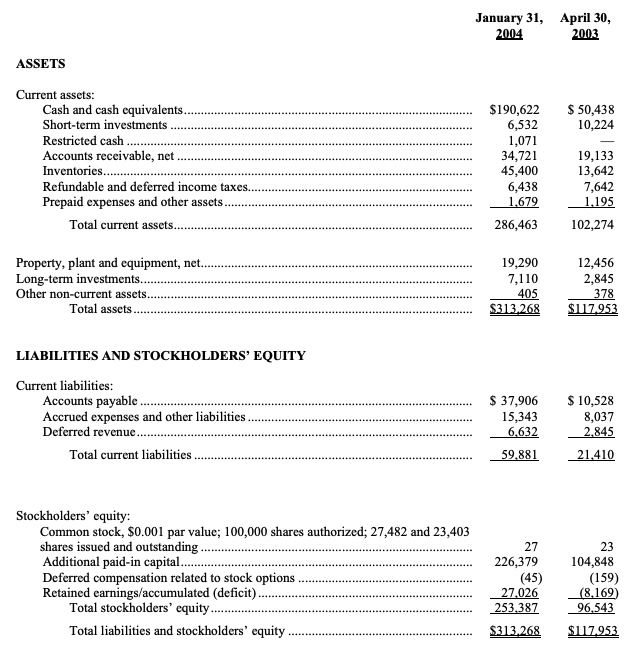

For the three months ended January 31, 2004, gross profit was $36.3 million, or 38.4% of revenue. In the comparable period a year ago, gross profit was $11.5 million, or 37.8% of revenue. For the three months ended January 31, 2004, direct sales to original equipment manufacturers and value-added resellers accounted for approximately 80% of revenue, with the balance of approximately 20% coming through distributors. During the quarter, total cash and short-term investments increased by $12 million, to $198 million. As of January 31, 2004, working capital was $227 million, and stockholders’ equity was $253 million.

For the quarter ending April 30, 2004, the Company currently expects to report earnings per diluted share of $0.30 to $0.31, adjusted for the effect of the stock split, on revenue of $96 million to $100 million.

Teleconference

At 1:30 p.m. PST (4:30 p.m. EST) today, February 18, 2004, the Company will hold a teleconference to discuss the financial results and future plans and prospects. To participate in the teleconference, please call (toll free) 877‑523‑2171 approximately 10 minutes prior to the start time. For international callers, the dial-in number is 706‑634‑1478. Additionally, a playback of the call will be available for 48 hours beginning at 4:30 p.m. PST on February 18. You may access the playback by calling 800‑642‑1687, or for international callers 706‑645‑9291, and providing Conference ID number 5086884.

You may also listen live via the Internet at the Company’s Website, www.ovt.com, or at www.FullDisclosure.com. These websites will also host an archive of the teleconference.

Safe-Harbor Statement

Certain statements in this press release, including statements relating to the Company’s expectations regarding revenue and earnings per share for the quarter ending April 30, 2004, are “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s current expectations, and actual results may differ materially from those projected as a result of certain risks and uncertainties. These risks and uncertainties include, without limitation, the following: the degree to which intense competition might affect the Company’s ability to compete successfully in current and emerging markets for image sensor products; risks associated with the Company’s ability to obtain design wins from camera, mobile phone and other image sensor device manufacturers, which could inhibit the Company’s ability to sustain and grow its business; risks associated with wafer manufacturing yields and other manufacturing processes, which could materially and adversely affect the Company’s revenue and earnings and its ability to satisfy customer demand; risks associated with the Company’s planned streamlining and consolidation of manufacturing processes, which could adversely affect the Company’s operating expenses and its ability to sustain and expand its business; risks associated with the development of current and emerging markets for CMOS image sensor products, generally, and the Company’s products, specifically, which could result in lower revenue and earnings and adversely affect the Company’s business and prospects; risks associated with the development of new products, which would adversely affect the Company’s ability to compete successfully in the CMOS image sensor market; the Company’s dependence upon a few key customers, the loss of one or more of which could materially and adversely affect the Company’s business and results of operations; a decline in the average selling price of the Company’s products, which could result in a decline in the Company’s revenue and gross margins; and the other risks detailed from time to time in the Company’s Securities and Exchange Commission filings and reports, including, but not limited to, the Company’s most recent annual report filed on Form 10‑K and most recent quarterly report filed on Form 10‑Q. The Company disclaims any obligation to update information contained in any forward-looking statement.

(financial tables follow)

OMNIVISION TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

OMNIVISION TECHNOLOGIES, INC.

CONDENSED INCOME STATEMENTS

(in thousands, except per share amounts)

(Unaudited)