SANTA CLARA, Calif., — August 30, 2012 — OmniVision Technologies, Inc. (Nasdaq: OVTI), a leading developer of advanced digital imaging solutions, today reported financial results for the first quarter of fiscal 2013 that ended on July 31, 2012.

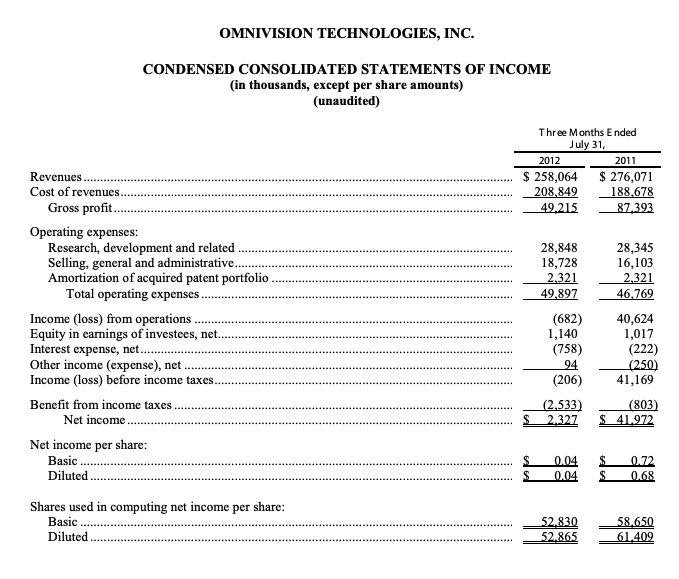

Revenues for the first quarter of fiscal 2013 were $258.1 million, as compared to $218.5 million in the fourth quarter of fiscal 2012, and $276.1 million in the first quarter of fiscal 2012. GAAP net income in the first quarter of fiscal 2013 was $2.3 million, or $0.04 per diluted share, as compared to net income of $2.7 million, or $0.05 per diluted share in the fourth quarter of fiscal 2012, and $42.0 million, or $0.68 per diluted share in the first quarter of fiscal 2012. GAAP net income in the first quarter of fiscal 2013 included a benefit from income taxes of $2.5 million.

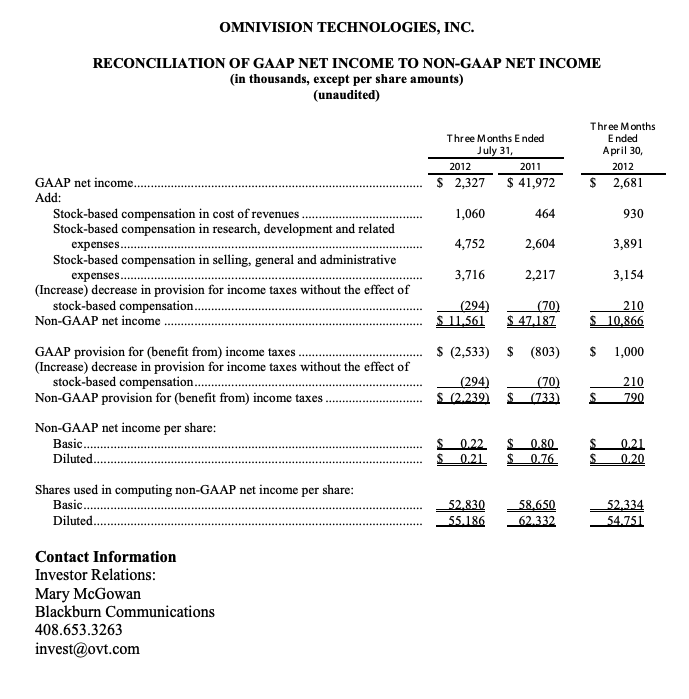

Non-GAAP net income in the first quarter of fiscal 2013 was $11.6 million, or $0.21 per diluted share. Non-GAAP net income in the fourth quarter of fiscal 2012 was $10.9 million, or $0.20 per diluted share. Non-GAAP net income in the first quarter of fiscal 2012 was $47.2 million, or $0.76 per diluted share. Non-GAAP net income excludes stock-based compensation expenses and the related tax effects. Please refer to the attached schedule for a reconciliation of GAAP net income to non-GAAP net income for the three months ended July 31, 2012, July 31, 2011 and April 30, 2012.

GAAP gross margin for the first quarter of fiscal 2013 was 19.1%, as compared to 22.5% for the fourth quarter of fiscal 2012 and 31.7% for the first quarter of fiscal 2012. The sequential decrease in first quarter gross margin reflected an increase in shipment of advanced products that had high manufacturing costs. We expect this trend to continue into at least the second quarter of fiscal 2013.

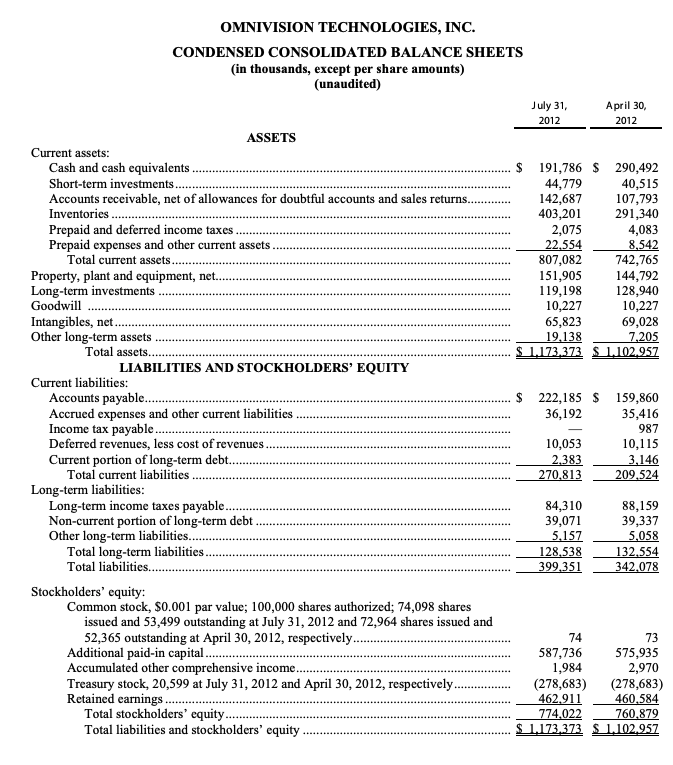

The Company ended the period with cash, cash equivalents and short-term investments totaling $236.6 million, a decrease of $94.4 million from the previous quarter. The decrease reflects a continued build-up of inventory to support the forecasted sequential increase in revenues.

“For the third consecutive quarter, we reported revenues that exceeded the high-end of our guidance, and we anticipate another sequential increase in our second-quarter revenues,” said Shaw Hong, chief executive officer of OmniVision Technologies, Inc. “While we are successful in rebuilding revenues momentum, our gross margins remain under pressure as a result of our current cost structure. We continue to take actions that we believe will lead to margin expansion over time.”

Outlook

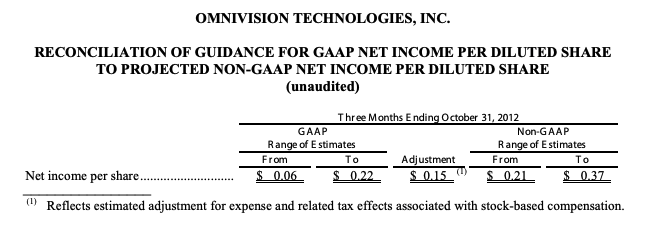

Based on current trends, the Company expects revenues for the second quarter of fiscal 2013 will be in the range of $355 million to $390 million and GAAP net income per share will be between $0.06 and $0.22 per diluted share. Excluding the estimated expense and related tax effects associated with stock-based compensation, the Company expects its non-GAAP net income per share will be between $0.21 and $0.37 per diluted share. Refer to the table below for a reconciliation of GAAP to non-GAAP net income.

Conference

Call OmniVision Technologies, Inc. will host a conference call today at 5:00 p.m. Eastern time to discuss these results further. This conference call can be accessed via a webcast at www.ovt.com. The call can also be accessed by dialing 866-383-7989 (domestic) or 617-597- 5328 (international) and entering passcode 54269243.

A replay of the call will remain available at www.ovt.com for approximately twelve months. A replay of the call will also be available for one week beginning approximately one hour after the conclusion of the call. To access the replay, dial 888-286-8010 (domestic) or 617-801- 6888 (international) and enter passcode 16278266.

Safe Harbor

Statement Certain statements in this press release, including statements relating to our expectations regarding revenues and earnings per share for the three months ending October 31, 2012 are forward-looking statements. These forward-looking statements are based on management’s current expectations, and certain factors could cause actual results to differ materially from those in the forward-looking statements. These factors include, without limitation, our ability to maintain and increase sales to current key customers and end-users of our products; fluctuations of wafer manufacturing costs, manufacturing yields, manufacturing capacity and other manufacturing processes and the impact on gross margins; the potential loss or reduction of orders from one or more key customers or distributors; the continued growth and development of current markets and the emergence of new markets in which the Company sells, or may sell, its products; fluctuations in sales mix and average selling prices; our ability to timely complete the product development cycle for new sensors; the Company’s ability to obtain design wins from various image sensor device manufacturers including manufacturers of mobile phones, tablets and other entertainment devices, laptops and personal computers, digital still cameras and automobile manufacturers; competition in current and emerging markets for image sensor products, including pricing pressures that could result from competition; the impact of general economic conditions on orders from the end-user customers of our products; the Company’s ability to accurately forecast customer demand for its products; the market acceptance of products into which the Company’s products are designed; the development, production, introduction and marketing of new products and technology; the acceptance of the Company’s products in such current and new markets; the Company’s strategic investments and relationships, and other risks detailed from time to time in the Company’s Securities and Exchange Commission filings and reports, including, but not limited to, the Company’s most recent Annual Report on Form 10-K and recent Quarterly Reports on Form 10-Q. The Company expressly disclaims any obligation to update information contained in any forward-looking statement.

Use of Non-GAAP Financial Information

To supplement the reader’s overall understanding of both its reported results presented in accordance with U.S. generally accepted accounting principles (“GAAP”) and its outlook, the Company also presents non-GAAP measures of net income and net income per share which are adjusted from results based on GAAP. In particular, the Company excludes stock-based compensation expenses and related tax effects. The non-GAAP financial measures which the Company discloses also exclude the effects of stock-based compensation on the number of basic and diluted common shares used in calculating non-GAAP basic and diluted net income per share. The Company provides these non-GAAP financial measures to enhance an investor’s overall understanding of its current financial performance and to assess its prospects for the future. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with its GAAP results and the accompanying reconciliations to the corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting the Company’s business. The economic basis for the Company’s decision to use non-GAAP financial measures is that the adjustments to net income did not reflect the on-going relative strength of the Company’s performance. The Company’s objective is to minimize any confusion in the financial markets by providing nonGAAP net income and non-GAAP net income per share measurements and disclosing the related components. These non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the financial measures prepared in accordance with GAAP.

The Company uses non-GAAP financial measures for internal management purposes to conduct and evaluate its business, when publicly providing its business outlook and to facilitate period-to-period comparisons. The Company views non-GAAP net income per share as a primary indicator of the profitability of its underlying business. In addition, because stock-based compensation is a non-cash expense and is offset in full by a credit to paid-in capital, it has no effect on total stockholders’ equity. As the calculation of non-GAAP financial measures differs between companies, the non-GAAP financial measures used by the Company may not be comparable to similarly titled measures used by other companies. Other than stock-based compensation and related tax effects, these differences may cause the Company’s non-GAAP measures to not be directly comparable to other companies’ non-GAAP measures. Although these non-GAAP financial measures adjust cost, expenses and basic and diluted share items to exclude the accounting treatment of stock-based compensation, they should not be viewed as a non-GAAP presentation reflecting the elimination of the underlying stock-based compensation programs. Thus, the Company’s non-GAAP presentations are not intended to present, and should not be used, as a basis for assessing what its operating results might be if it were to eliminate its stock-based compensation programs. The Company compensates for these limitations by providing full disclosure of the net income and net income per share on a basis prepared in accordance with GAAP to enable investors to consider net income and net income per share determined under GAAP as well as on an adjusted basis, and perform their own analysis, as appropriate. As a result of the foregoing limitations, the Company does not use, nor does the Company intend to use, the non-GAAP financial measures when assessing the Company’s performance against that of other companies.

Estimating stock-based compensation expense and the related tax effects for a future period is subject to inherent risks and uncertainties, including but not limited to the price of the Company’s stock, stock market volatility, expected option life, risk-free interest rates, and the number of option exercises and sales during the quarter.