SANTA CLARA, Calif., — August 28, 2014 — OMNIVISION Technologies, Inc. (Nasdaq: OVTI), a leading developer of advanced digital imaging solutions, today reported financial results for the first quarter of fiscal 2015 that ended on July 31, 2014.

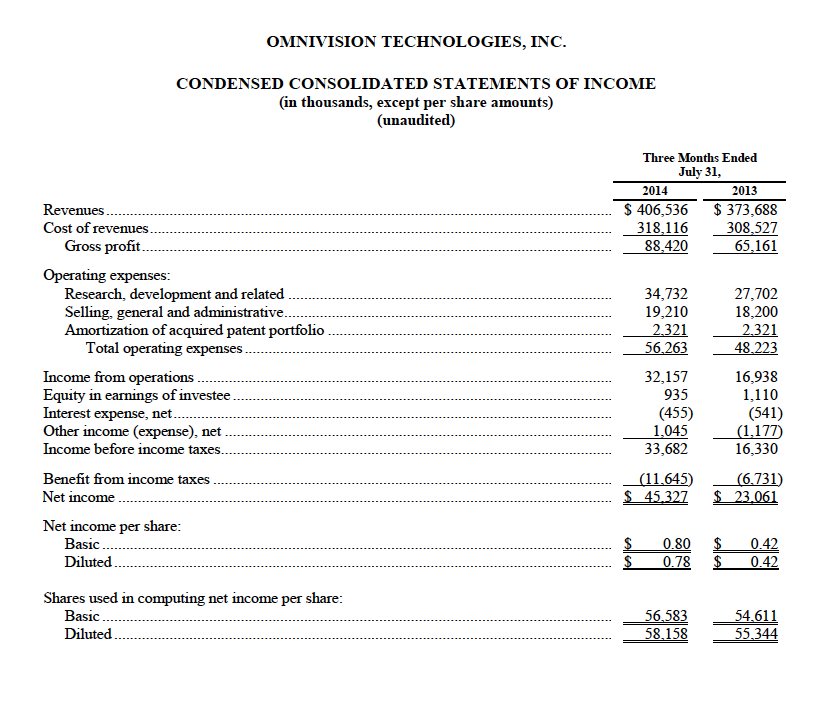

Revenues for the first quarter of fiscal 2015 were $406.5 million, as compared to $331.0 million in the fourth quarter of fiscal 2014, and $373.7 million in the first quarter of fiscal 2014. GAAP net income in the first quarter of fiscal 2015 was $45.3 million, or $0.78 per diluted share, as compared to net income of $15.1 million, or $0.26 per diluted share in the fourth quarter of fiscal 2014, and $23.1 million, or $0.42 per diluted share in the first quarter of fiscal 2014. For the first quarter of fiscal 2015, the Company recorded a non-cash tax benefit of $15.1 million, as compared to $8.9 million for the first quarter of fiscal 2014. These tax benefits reflected the lapse of applicable statutes of limitations in certain foreign jurisdictions.

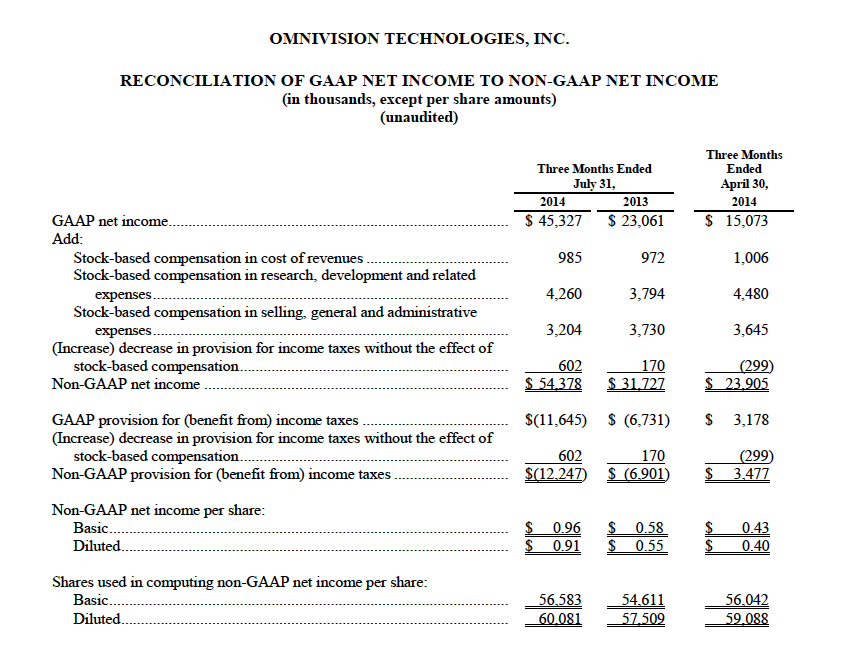

Non-GAAP net income in the first quarter of fiscal 2015 was $54.4 million, or $0.91 per diluted share. Non-GAAP net income in the fourth quarter of fiscal 2014 was $23.9 million, or $0.40 per diluted share. Non-GAAP net income in the first quarter of fiscal 2014 was $31.7 million, or $0.55 per diluted share. Non-GAAP net income excludes stock-based compensation expenses and the related tax effects. Please refer to the attached schedule for a reconciliation of GAAP net income to non-GAAP net income for the three months ended July 31, 2014, July 31, 2013 and April 30, 2014.

GAAP gross margin for the first quarter of fiscal 2015 was 21.7%, as compared to 20.1% for the fourth quarter of fiscal 2014 and 17.4% for the first quarter of fiscal 2014. The sequential increase in first quarter gross margin reflected a favorable product mix shift towards our newer and higher resolution products.

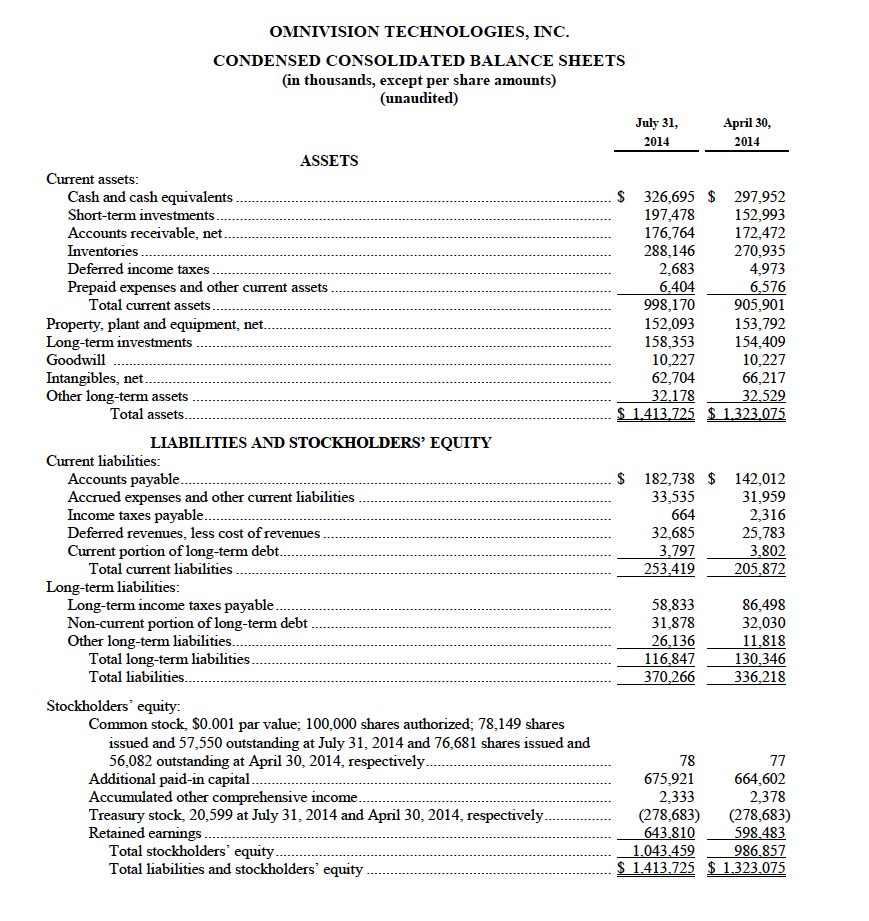

The Company ended the period with cash, cash equivalents and short-term investments totaling $524.2 million, an increase of $73.2 million from the previous quarter. The increase was primarily attributable to cash provided by operating activities in the first quarter of fiscal 2015.

“We are pleased with our strong results for the first quarter, driven primarily by our mobile phones and automotive businesses. In addition, we continued to see improvements on multiple financial metrics, including gross margin and cash balance,” said Shaw Hong, chief executive officer of OMNIVISION Technologies, Inc. “We are proud of our strong execution in ramping up multiple members of our PureCel® sensor family for our mobile phone customers. We believe that the secular trend towards 4G and smartphones, especially in China and India, will drive our growth in the near-term.”

Outlook

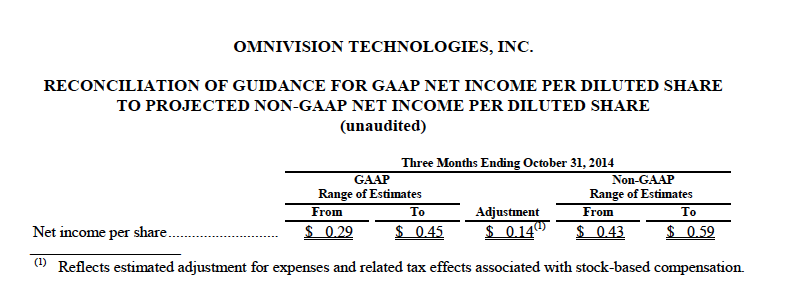

Based on current trends, the Company expects revenues for the second quarter of fiscal 2015 will be in the range of $360 million to $390 million and GAAP net income per share will be between $0.29 and $0.45 per diluted share. Excluding the estimated expense and related tax effects associated with stock-based compensation, the Company expects its non-GAAP net income per share will be between $0.43 and $0.59 per diluted share. Refer to the table below for a reconciliation of GAAP to non-GAAP net income.

Conference Call

OMNIVISION Technologies, Inc. will host a conference call today at 5:00 p.m. Eastern time to discuss these results further. This conference call can be accessed via a webcast at www.ovt.com. The call can also be accessed by dialing 877-415-3179 (domestic) or 857-244-7322 (international) and entering passcode 74279438.

A replay of the call will remain available at www.ovt.com for approximately twelve months. A replay of the call will also be available for one week beginning approximately one hour after the conclusion of the call. To access the replay, dial 888-286-8010 (domestic) or 617-801-6888 (international) and enter passcode 84123985.