SUNNYVALE, Calif. — November 30, 2004 — OMNIVISION Technologies, Inc. (Nasdaq: OVTI) today reported that in the three months ended October 31, 2004, it earned $17.8 million, or $0.28 per diluted share, on revenue of $84.4 million, compared to $13.8 million, or $0.23 per diluted share, on revenue of $78.0 million in the comparable period a year ago.

For the six months ended October 31, 2004, OMNIVISION earned $37.6 million, or $0.60 per diluted share, on revenue of $183.2 million, compared to $20.1 million, or $0.35 per diluted share, on revenue of $124.8 million in the first six months of fiscal 2004.

Commenting on the results for the quarter, Shaw Hong, OMNIVISION’s president and chief executive officer, said: “In spite of the expected revenue decline from the previous quarter, OMNIVISION maintained excellent profitability and generated $34.5 million in cash from operations. In addition, our outlook for the coming quarter indicates a return to top-line growth. We are especially pleased with the progress we are making in transitioning the Company’s product line to the OmniPixel® platform. Our 5‑megapixel CameraChip™, which we introduced at Photokina in September, is now ready for volume production, and we expect to see it appearing in consumer products during the first quarter of calendar 2005. We believe that our new OmniPixel® technology gives OMNIVISION a strong product line-up for all of the markets we serve now and many of the markets that we expect to serve in the future.”

Gross profit for the second quarter of fiscal 2005 was $38.2 million, or 45.3 percent of revenue, compared to $29.6 million, or 37.9 percent of revenue, for the second quarter of fiscal 2004, and $39.7 million, or 40.2 percent of revenue, for the first quarter of fiscal 2005. Second-quarter 2005 gross margin reflects a $1.4 million credit to cost of goods sold pursuant to settlement of a dispute regarding the late cancellation of an order from one of the Company’s customers; without the credit, gross margin would have been 43.6 percent.

During the quarter, total cash, cash equivalents and short-term investments increased by $33.6 million to $281.3 million. Stockholders’ equity increased by $19.2 million to $340.1 million.

For the third quarter of fiscal 2005, ending January 31, 2005, the Company currently expects that diluted earnings per share will be in the range of $0.24 to $0.29 on revenues of $90 million to $100 million.

Teleconference

At 1:30 p.m. PST (4:30 p.m. EST) today, November 30, 2004, the Company will hold a teleconference to discuss the financial results. To participate in the teleconference, please call (toll free) 877‑523‑2171 approximately 10 minutes prior to the start time. For international callers, the dial-in number is 706‑634‑1478. You may also listen live via the Internet at the Company’s web site, www.ovt.com, or at www.FullDisclosure.com. These web sites will host an archive of the teleconference. Additionally, a playback of the call will be available for 48 hours beginning at 4:30 p.m. PST on November 30. You may access the playback by calling 800‑642‑1687, or for international callers 706‑645‑9291, and providing Conference ID number 2052613.

Safe-Harbor Statement

Certain statements in this press release, including statements relating to the Company’s expectations regarding revenue and earnings per share for the quarter ending January 31, 2005, statements relating to returning to top-line growth, statements regarding transitioning our product line to the OmniPixel® platform, statements regarding our expectations for our 5‑megapixel CameraChip™ product, and statements regarding our expectations for our OmniPixel® technology are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s current expectations, and as a result of certain risks and uncertainties actual results may differ materially from those projected. These risks and uncertainties include, without limitation, the following: the degree to which intense competition might affect the Company’s ability to compete successfully in current and emerging markets for image sensor products; risks associated with the Company’s ability to obtain design wins from camera, mobile phone and other image sensor device manufacturers, which could inhibit the Company’s ability to sustain and grow its business; risks associated with wafer manufacturing yields and other manufacturing processes, which could materially and adversely affect the Company’s revenue and earnings and its ability to satisfy customer demand; risks associated with the Company’s planned streamlining and consolidation of manufacturing processes, which could adversely affect the Company’s operating expenses and its ability to sustain and expand its business; risks associated with the development of current and emerging markets for CMOS image sensor products, generally, and the Company’s products, specifically, which could result in lower revenue and earnings and adversely affect the Company’s business and prospects; risks associated with the Company’s ability to accurately forecast customer demand for its products, which could impair the Company’s ability to meet customer demand for CameraChip™ products and could also result in excess inventory; risks associated with the development, production, introduction and marketing of new products and technology, including our 5‑megapixel CameraChip™ product and our new OmniPixel® technology, which would adversely affect the Company’s ability to compete successfully in the CMOS image sensor market; the Company’s dependence upon a few key customers, the loss of one or more of which could materially and adversely affect the Company’s business and results of operations; uncertainties associated with the Company’s decision to restate certain of its fiscal 2004 quarterly results of operation; our ability to strengthen our internal controls over financial reporting and maintain an adequate level of financial processes and controls; a decline in the average selling price of the Company’s products, which could result in a decline in the Company’s revenue and gross margins; and the other risks detailed from time to time in the Company’s Securities and Exchange Commission filings and reports, including, but not limited to, the Company’s most recent annual report filed on Form 10‑K, as amended, and in the Company’s most recent quarterly report filed on Form 10‑K. The Company disclaims any obligation to update information contained in any forward-looking statement.

(financial tables follow)

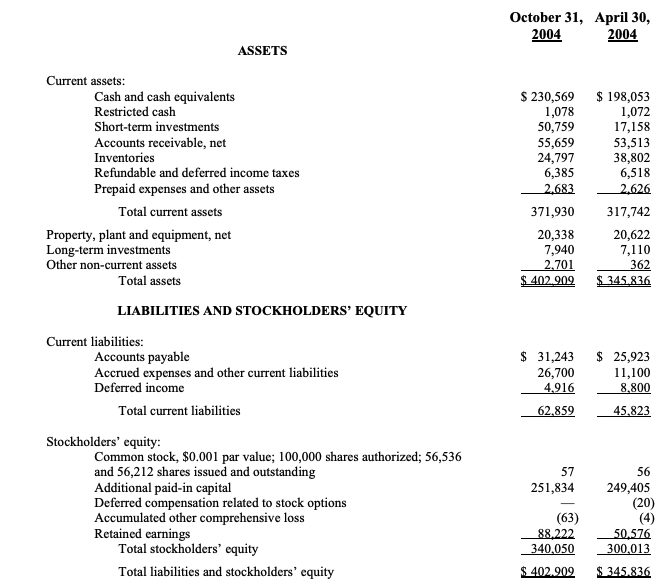

OMNIVISION TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED INCOME STATEMENTS

(in thousands, except per share amounts) (unaudited)

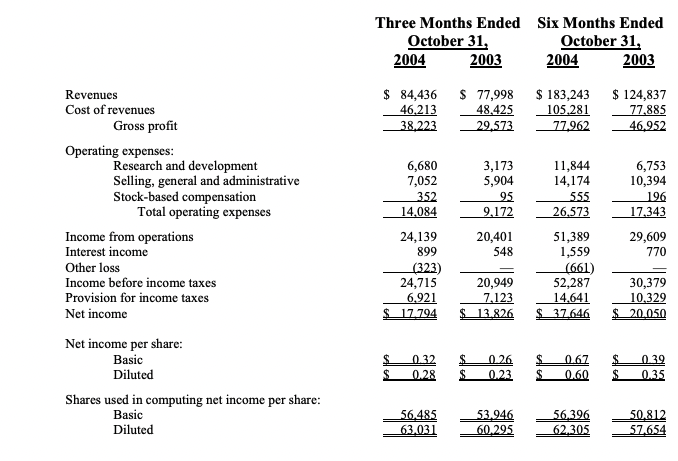

OMNIVISION TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)