~ Revenues Grow 43% Year-Over-Year ~

~ James He Promoted to Chief Operating Officer and Ray Cisneros Promoted to VP of Sales ~

Sunnyvale, California, August 31, 2006 – OmniVision Technologies, Inc. (Nasdaq: OVTI), a leading supplier of CMOS image sensors, today reported financial results for the quarter ended July 31, 2006, the first quarter of its 2007 fiscal year.

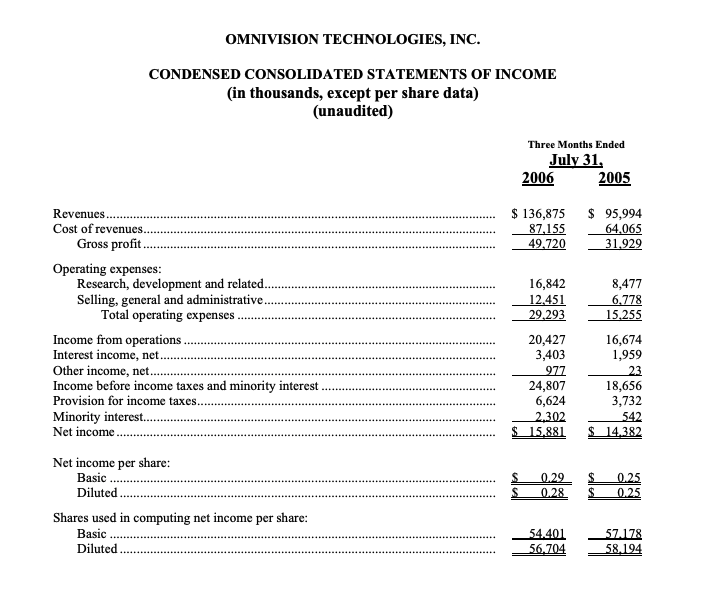

Revenue for the first quarter was $136.9 million, compared to $131.8 million in the fourth quarter of fiscal 2006, and $96.0 million in the first quarter of fiscal 2006. GAAP net income in the quarter, the first in which the Company recognized stock-based compensation expense under FAS 123(R), was $15.9 million, or $0.28 per diluted share, compared to net income of $22.5 million, or $0.39 per diluted share, in the fourth quarter 2006, and net income of $14.4 million, or $0.25 per diluted share, in the prior year period.

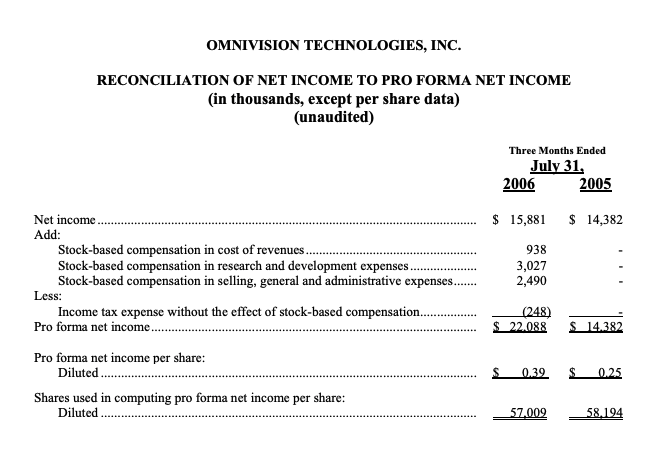

Net income for the quarter includes a $6.5 million impact of stock-based compensation expense recognized in the quarter as a result of the adoption of FAS 123(R) on May 1, 2006. Net income reported in prior periods did not include stock-based compensation expense under FAS 123(R). Excluding stock-based compensation expense and the related tax effect, non-GAAP net income in the first quarter of fiscal 2007 was $22.1 million and earnings were $0.39 per diluted share. Refer to the table below for a reconciliation of GAAP to non-GAAP net income.

Gross margin for the first quarter was 36.3% compared to 36.8% last quarter. During the quarter, the Company recognized the benefit of $2.2 million of compensation from suppliers whose product quality in previous periods did not meet the Company’s quality standards.

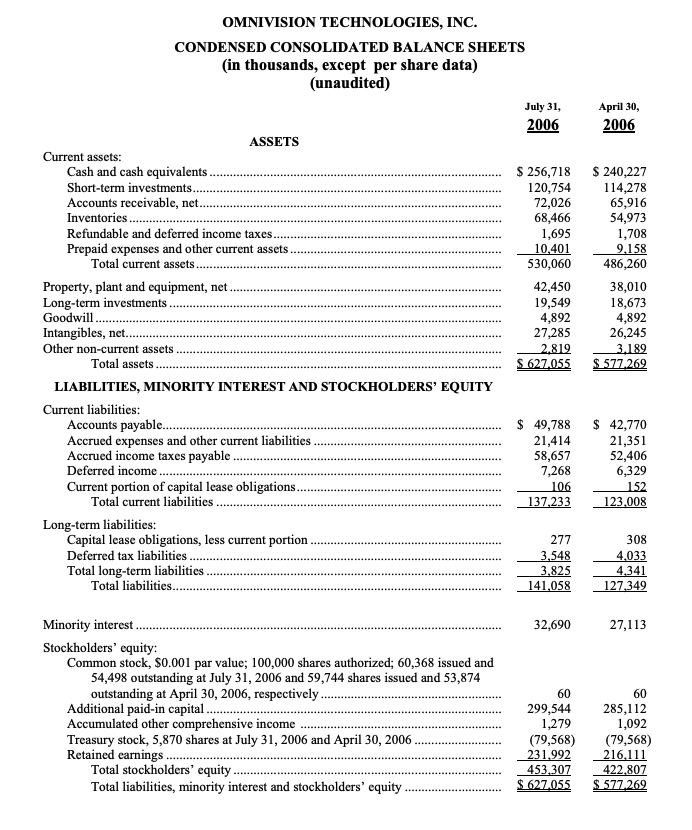

The Company ended the period with cash, cash equivalents and short-term investments totaling $377.5 million.

“We are pleased to report approximately 43% year-over-year revenue growth in the first quarter,” said Shaw Hong, OmniVision’s president and chief executive officer. “During the quarter, we began shipping in volume the world’s first quarter-inch 2 megapixel sensors into the mobile handset market. Additionally, we achieved significant growth in security and surveillance as we continue to expand our presence in the higher end commercial security systems. Growth in toys and games was also robust as our customers began ramping production for the holiday season.

“We are delighted to announce the promotions of James He to chief operating officer and Ray Cisneros to vice president of sales. Both of these individuals have already made significant contributions to the organization and are an integral part of the team that will help propel OmniVision to the next level,” concluded Hong.

James He, who has been with OmniVision since 1995, most recently fulfilled the role of senior vice president of engineering. James has held many positions with the Company, including vice president of core technologies, director of core technologies and design manager. He has directed sensor array research and development for both analog and digital CameraChips™, as well as managing the MIS department. Sensor array advancements are at the heart of CameraChip™ improvements, and James’ engineering and management skills have ensured the continuing technological success of OmniVision products. James earned both his B.S. and M.S. in Electrical Engineering at Tsinghua University in Beijing, China.

Ray Cisneros, who has been with OmniVision since 2002 as its director of sales, brings extensive semiconductor experience to his new position. Ray spent several years in various marketing, business development and product management positions at Sagitta, a fiber optics start up, UMC, one of the world’s largest semiconductor foundry companies and Novellus Systems. Ray earned his B.S. in Metallurgical and Materials Engineering from the Illinois Institute of Technology and his MBA in Marketing at Golden Gate University.

Outlook

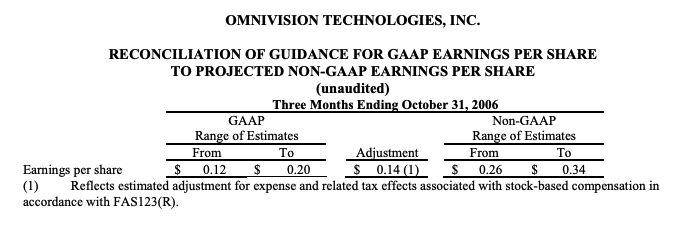

Based on current trends, the Company expects fiscal second quarter 2007 revenue will be in the range of $135-$145 million and earnings will be between $0.12 and $0.20 per share, on a diluted basis. Excluding the estimated expense and related tax effects associated with stock-based compensation in accordance with FAS123(R), the Company expects non-GAAP earnings will be in the range of $0.26 to $0.34 per share, on a diluted basis.

Conference Call

OmniVision Technologies will host a conference call today to further discuss these results at 2:00 p.m. Pacific Time. This conference call may be accessed by dialing 866-700-7441 or 617-213-8839 and indicating passcode 24257830. The call can be accessed via a webcast at www.ovt.com.

A replay of the call will be available for forty eight hours beginning approximately one hour after the call. To access this replay, dial 617-801-6888 and enter passcode 21097328. A Web replay will be available for approximately twelve months days at www.ovt.com.

Safe Harbor Statement

Certain statements in this press release, including statements relating to the Company’s expectations regarding its ability to continue to expand its presence in certain markets, the ability of its management team to help take the Company to the next level, the continued technological success of the Company’s products, and revenue and earnings per share for the quarter ending October 31, 2006. These forward-looking statements are based on management’s current expectations, and important factors could cause actual results to differ materially from those in the forward-looking statements. These important factors include, without limitation, competition in current and emerging markets for image sensor products, including pricing pressures; the Company’s ability to obtain design wins from various image sensor device manufacturers including manufacturers of mobile phone, digital still cameras and automobile manufacturers; wafer manufacturing yields and other manufacturing processes; the Company’s ability to accurately forecast customer demand for its products; the development, production, introduction and marketing of new products and technology; the potential loss of one or more key customers or distributors; the continued growth and development of current markets and the emergence of new markets in which the Company sells, or may sell, its products; the acceptance of the Company’s products in such current and new markets; the Company’s strategic investments and relationships, and other risks detailed from time to time in the Company’s Securities and Exchange Commission filings and reports, including, but not limited to, the Company’s most recent annual report filed on Form 10-K. The Company expressly disclaims any obligation to update information contained in any forward-looking statement.

Use of Non-GAAP Financial Information

To supplement both our reported results and our outlook, we use a non-GAAP measure of earnings per share which excludes stock-based compensation under FAS 123(R) and related tax effects to allow for a better comparison of results to those in prior periods that did not include such stock-based compensation. We believe the non-GAAP measure that excludes stock-based compensation under FAS 123(R) and related tax effects enhances the comparability of results against prior periods. In addition, because stock-based compensation expense is offset by a credit to paid-in capital, it has no effect on total stockholders’ equity, and no effect on cash flows.

Estimating stock-based compensation expense and the related tax effects for a future period is subject to inherent risks and uncertainties, including but not limited to the Company’s stock price and the number of option exercises and sales during the quarter. In addition, we use this non-GAAP financial measure for internal management purposes, when publicly providing our business outlook and as a means to evaluate period-to-period comparisons. This non-GAAP financial measure should be considered as a supplement to, and not as a substitute for, or superior to, the financial measure prepared in accordance with GAAP.